blog

Aumenta la Cautela nel Mercato delle Borse: Ecco Perché

Aumenta la Cautela nel Mercato delle Borse: Ecco Perché

Il mondo della finanza è noto per la sua natura volatile e imprevedibile. In tempi di incertezza economica e geopolitica, gli operatori dei mercati finanziari diventano particolarmente cauti. Secondo un recente sondaggio condotto da Assiom Forex, la cautela sta aumentando notevolmente tra gli operatori, con un calo significativo nelle previsioni di crescita del mercato azionario per i prossimi sei mesi.

Tensioni Globali e L’Impatto sull’Economia Europea

Le ragioni di questa crescente prudenza sono molteplici. Fattori come l’aumento dei tassi di interesse, le tensioni in Ucraina e un rallentamento economico in Cina stanno tutti contribuendo a un clima di incertezza. A peggiorare la situazione, dati recenti mostrano una frenata significativa nell’economia della Germania, la locomotiva economica dell’Europa.

Massimo Mocio, presidente di Assiom Forex, sottolinea come l’aumento dei prezzi energetici e il deterioramento dei dati macroeconomici nell’Eurozona stiano alimentando questa crescente cautela. In particolare, le preoccupazioni riguardano il potenziale impatto negativo sulla capacità di consumo delle famiglie.

Euro vs Dollaro: Una Battaglia Stabile

Tendenze del Mercato dei Cambi

Nel mercato dei cambi, la maggior parte degli operatori prevede una stabilità relativa tra euro e dollaro americano nei mesi a venire. Solo un mese fa, il 35% degli operatori finanziari prevedeva un rafforzamento dell’euro. Ora, quella cifra è scesa al 27%, mentre la percentuale di coloro che si aspettano una stabilità è salita dal 47% al 56%.

Le Politiche Monetarie e il Dollaro

Le politiche monetarie della Federal Reserve statunitense e della Banca centrale europea sembrano essere giunte a un punto di stallo, ma con una differenza significativa: l’economia americana sembra essere molto più resiliente di quella europea. Questo fattore, insieme ai segnali positivi provenienti dall’economia statunitense, potrebbe portare a un ulteriore rafforzamento del dollaro nei mesi a venire.

Lo Spread e il Futuro dell’Economia Europea

Altro tema di preoccupazione è lo spread tra i titoli di stato italiani e tedeschi. Sebbene la maggioranza degli operatori finanziari preveda che lo spread rimarrà entro un range stabile, una percentuale crescente teme un suo possibile aumento. La questione è ulteriormente complicata dalle discussioni in corso sulla riforma del Patto di Stabilità e Crescita dell’UE, che potrebbero avere un impatto significativo sui paesi con elevati livelli di debito.

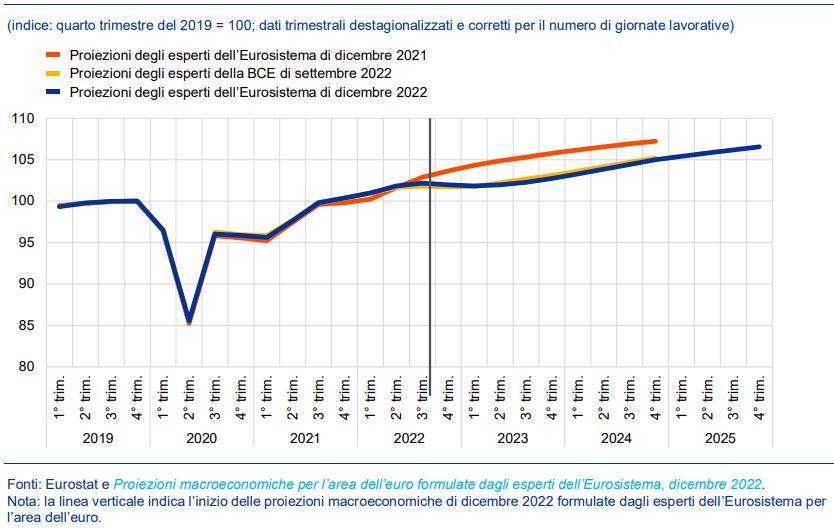

Recessione in Vista per l’Economia dell’Eurozona

Segnali di Recessione

L’economia dell’Eurozona mostra segni inquietanti. Il 55% degli operatori del sondaggio di Assiom Forex ritiene che ci siano probabilità di una recessione nel prossimo semestre. Questa preoccupazione è alimentata da una varietà di fattori, tra cui una crescita economica inferiore alle attese in Cina e la continua incertezza geopolitica.

Ottimismo o Pessimismo?

Nonostante le preoccupazioni, c’è una minoranza significativa del 45% degli operatori che rimane ottimista, sottolineando la potenziale resilienza del mercato del lavoro e un calo dell’inflazione che potrebbe sostenere i consumi.

In conclusione, la maggior parte degli operatori dei mercati finanziari è oggi cauta, spinta da una serie di fattori che vanno dalla geopolitica ai dati economici. In un tale clima, la prudenza sembra essere la strategia più saggia per navigare attraverso le acque tumultuose dei mercati finanziari globali.