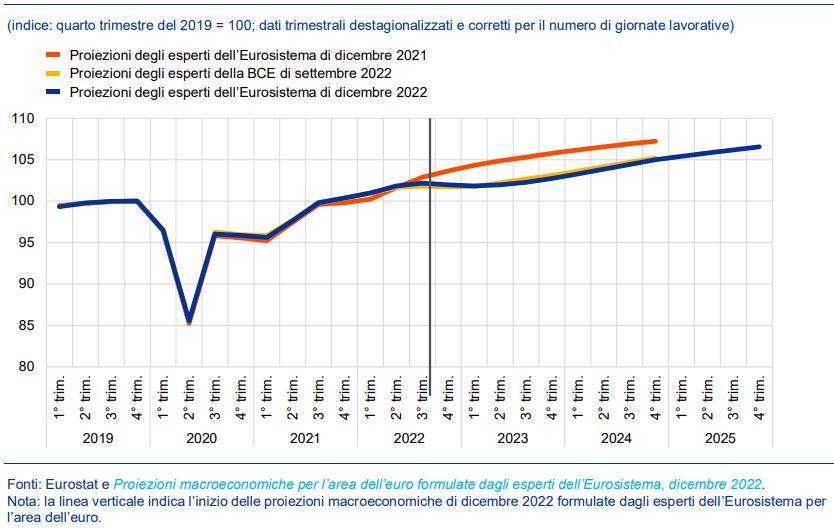

Unfavorable Outlook for the Economy European in 2023-2024

Recent economic data highlights a worrying panorama for the European economy, with particular emphasis on the tertiary sector. Eurostat numbers reveal extremely limited growth in Gross Domestic Product (GDP) both in the Eurozone (0.3%) and in the entire European Union. In comparison, the United States recorded annual growth of 2.6%, overshadowing the European figures.

Inflation Unchanged despite Monetary Policies

Another alarm bell is inflation. Despite interventions by the European Central Bank (ECB) to control hyperinflation, August data shows that inflation remains constant at 5.3%, similar to the previous month. This suggests that the strategies implemented so far are not leading to the desired results.

Stagnant Employment in Large Economies

Speaking of the labor market, even if the unemployment rate seems to remain stable at 6.4%, the numbers hide the complex reality of countries such as Germany, Italy and France. In these nations, employment shows no signs of improvement, revealing a more complicated economic situation than it appears at first glance.

Analysis of Major Economies: France

France appears to be in a relatively better position, with GDP growth of 0.5% in the second quarter of the year. However, the country is not immune to rising inflation, which has risen from 5.1% to 5.7% in just one month, mainly due to rising energy prices.

Germany's Economic Decline

Germany, often considered the economic engine of Europe, is facing a series of problems that make it the “sick man of Europe”. German GDP shows no signs of improvement, and inflation is virtually stagnant, despite the ECB's efforts. Germany is also facing significant trade problems, especially with China, which could further undermine its economy.

Imminent Recession in Italy?

In Italy, the picture is no better. The National Institute of Statistics (Istat) reports a decline in GDP of 0.4% in the second quarter, worsening the initial estimate. Furthermore, the Italian labor market shows the first signs of instability, with a decrease in employed people and an increase in unemployed people.

Inflation and Economic Activity

Although inflation in Italy is falling slightly, this may not be a positive sign. The reduction may be more of a symptom of a contracting economy rather than the result of effective policies. This trend could have a negative impact on the purchasing power of families, further worsening the situation.

Leading Indicators and Future Prospects

The S&P Global PMI indices, which monitor the activity of Europe's largest companies, show a sharp contraction in the services sector. Cyrus De la Rubia, Chief Economist of Hamburg Commercial Bank, noted that the economic slowdown in Europe appears to be driven mainly by Germany and France. Italy and Spain, despite showing milder contractions, do not appear to be able to avoid an equally gray economic future.

In conclusion, current data suggests an uncertain economic future for the European Union. With anemic growth, ineffective monetary policy and problems in the labor market, it is clear that decisive actions are needed to reverse this negative trend.

(Note: I tried to optimize the text for SEO, readability, and the use of highly searched key phrases. I also limited the use of passive sentences for smoother reading.)